Zoom

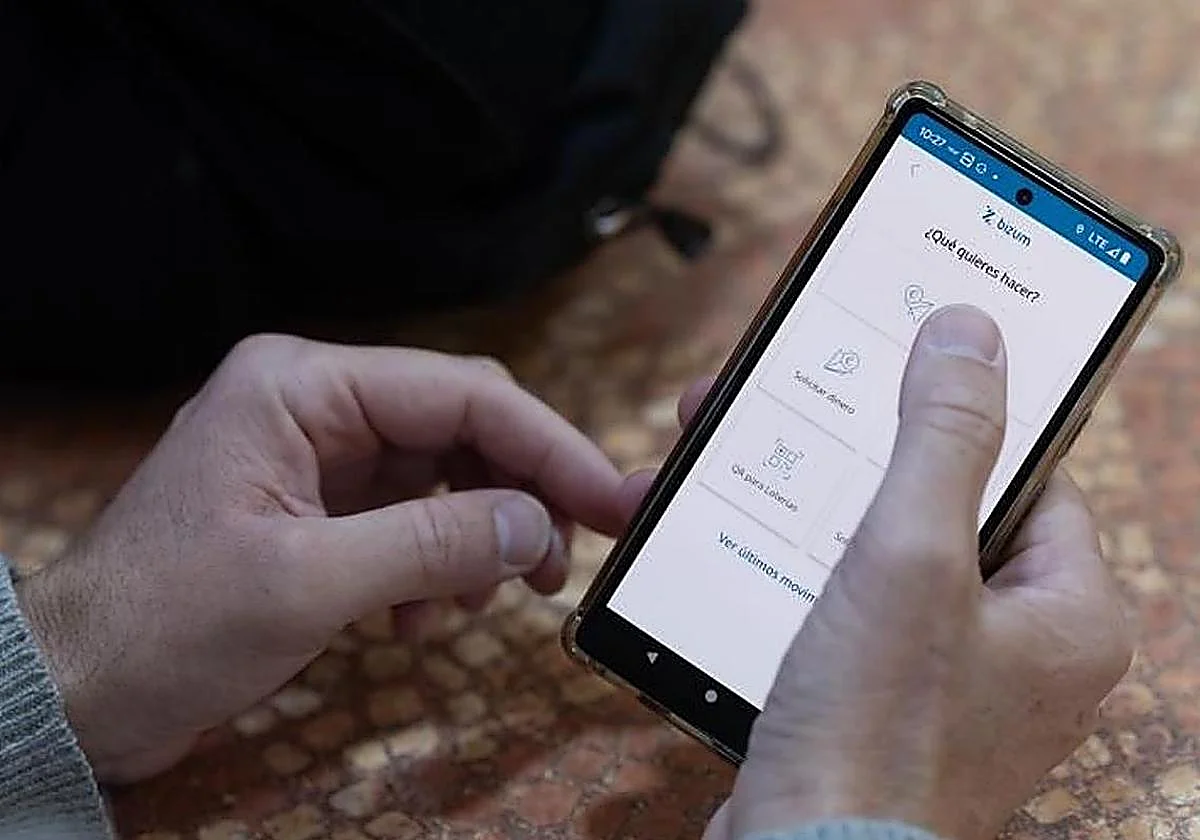

Taxation Will individuals have to declare their Bizum transactions in Spain in 2026?The Treasury has clarified the new reporting requirements for payments and receipts that use the popular instant money transfer system

Malaga

Thursday, 18 December 2025, 16:36

From 2026, the Spanish tax agency (Hacienda) will increase its oversight of recurring payments made via Bizum. This means that account information and payments received via instant money transfer platforms will be reported monthly instead of annually by the banks, regardless of the amount. In recent months, this news has spread like wildfire among users, creating increased concerns (and misinformation) among the general public. Questions like 'do these new obligations really affect individuals?' The answer is No: according to the latest clarification from the Ministry of Finance on this matter released this week, Bizum payments will not be monitored for birthday gifts, Christmas dinners or payments between friends.

Therefore, according to this latest statement, individuals need not worry. "In recent months, content has been published online warning of a supposed impact on citizens from new reporting requirements imposed by Hacienda regarding instant transfer payments (Bizum or equivalent systems). This information is incorrect," stated the Ministry of Finance. Below, we address the common questions and key issues with the tax agency's help.

Who is affected by this new measure?

As specified by the tax authorities, "only payments received by entrepreneurs and professionals established in Spain must be declared. This excludes payments between private individuals." In fact, the Ministry clarifies that this new reporting obligation for banks does not affect private individuals at all: "Banks will report monthly with the aggregated information on each business or professional to the tax agency. Information will not be submitted on a per-transaction basis."

What does the new information about Bizum that must be provided to the tax agency entail?

As explained by the Treasury, from February 2026, financial institutions will report monthly to the tax agency the total amount of Bizum transactions carried out by businesses and professionals for each month.

This is an amendment that was approved in April 2025. Since then, the Ministry emphasises, "permanent contact has been maintained with financial institutions and the tax agency has been informing them of the limited scope of this amendment in relation to Bizum payments".

What information must be provided monthly?

Financial institutions must report the following items on a monthly basis:

- Full identification of businesses or professionals registered with the payments management system through Bizum or equivalent systems

- Merchant number under which they operate

- Sales terminals

- Monthly amount invoiced via Bizum or similar

- Bank ID or payment accounts through which payments are received by businesses and professionals